How to Use Your FSA for Vision Correction Surgery

Is LASIK on your wish list so you won’t need to wear glasses or contacts all the time? Better vision is the benefit our patients love, but you’ll also save money on prescription glasses and contacts in the decades ahead. For patients covered by an employer’s FSA, or Flexible Spending Account, you have an additional resource to help make LASIK and other eye surgeries more affordable.

If your employer offers a Flexible Savings Account (FSA), it could serve as a savings account for laser vision correction. Learn how an FSA account works, what types of vision correction surgery it covers and how you can use it to pay for your vision correction surgery tax-free.

What Is an FSA?

An FSA, or a flexible spending account, is a special account you put money into that you use to pay for certain out-of-pocket health care costs. If you participate in an FSA, your employer withdraws a predetermined contribution from your paycheck to help cover the cost of medical, dental and vision expenses that your insurance doesn’t cover.

Can I Roll over My FSA Dollars?

FSAs are required to be used within a specific plan year. However, employers typically have two options to extend this deadline. For example, your employer could offer a grace period of up to two-and-a-half months to use your FSA funds. Or they could carry forward a balance of $550. Employers can use one but not both options to help employees maximize their FSA accounts.

What Expenses Does an FSA Cover?

With an FSA, many of the expenses not covered by typical health insurance include deductibles, copays, prescription drugs, diagnostic devices, medical devices. Since most insurance doesn’t cover LASIK surgery, you can use your FSA funds to offset some of that cost.

Can I Spend My FSA on Vision Correction Surgery?

Which Vision Correction Surgeries are Covered by FSAs?

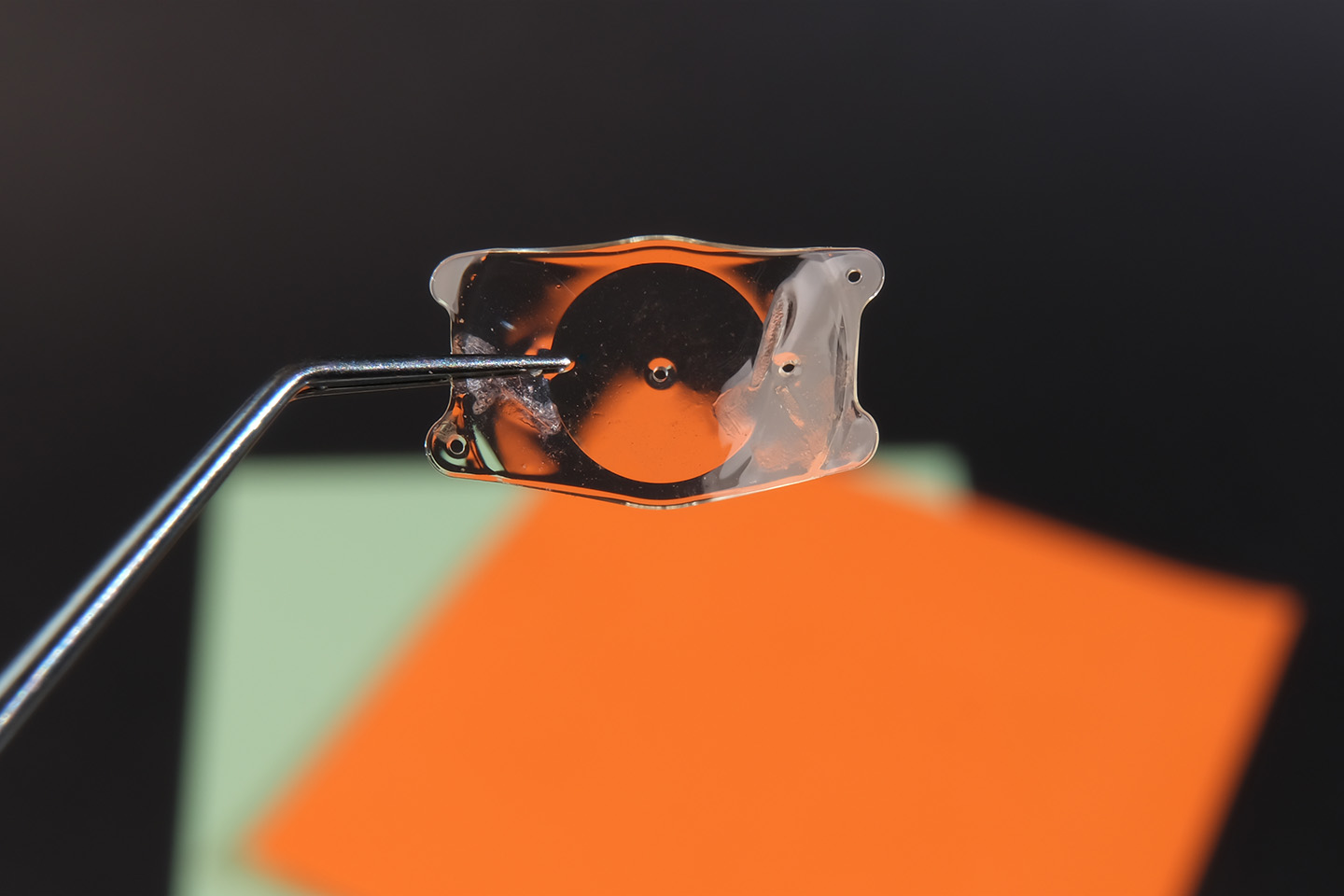

LASIK, PRK, Visian ICL, and Clear Lens Exchange can be funded at least in part by your FSA account.

How Does It Work?

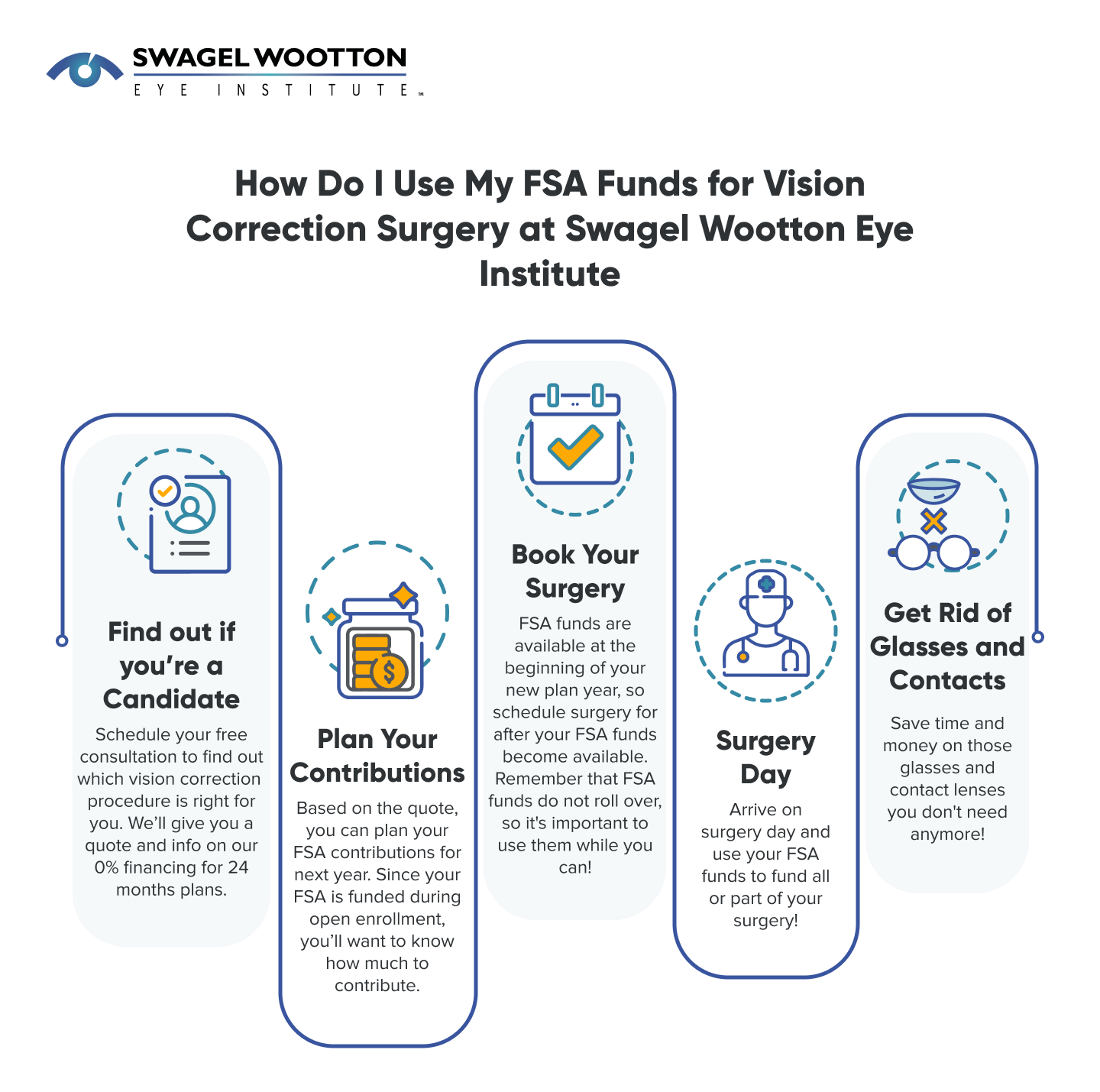

The first step in using your HSA funds to pay for your vision correction surgery is to find out if you’re a candidate and learn which vision correction procedure is right for you. During your free consultation, our team of eye doctors will discuss what’s best for your vision and explain the costs associated with your chosen surgical treatment.

Based on a personalized quote, you can plan your FSA contributions for the following year to be sure you have the appropriate funds to pay for all or part of your vision correction surgery. Since your FSA is funded during the open enrollment period, it’s important to know how much you’ll need to set aside.

Since FSA funds are accessible at the beginning of your new plan year you can schedule your surgery as soon as you’d like after your FSA funds become available.

If you have an FSA debit card, you can use that to pay for your procedure on the day of surgery. If not, your employer will handle your FSA claim for reimbursement, which will include proof of the medical expense and a statement that it wasn’t covered by your health plan. The FSA plan will then issue a reimbursement to you.

Our Patient Care Team Can Help Combine Your FSA with Other Resources to Meet Your Vision Goals

At Swagel Wootton Eye Institute, we can help you achieve your vision correction goals. Our eye doctors in Mesa and Chandler provide excellence in vision care, and our patient care team works hard for you as well, answering questions about eye care, procedures, and financing options. We can help you find and combine resources to meet your goals, including your FSA account, employer-based discounts, and other resources. Schedule your free consultation today!

[DISPLAY_ULTIMATE_SOCIAL_ICONS]